President Barack Obama will propose a $10 per barrel tax on oil in his fiscal 2017 budget plan, an idea that received a chilly reception in the Republican-controlled Congress that oversees spending.

With the proceeds targeted to transportation and climate initiatives, the proposal announced Thursday deepens Obama’s environmental credentials and signifies his ambitions to aggressively push action on climate change during his final year in office.

"By placing a fee on oil, the president’s plan creates a clear incentive for private-sector innovation to reduce our reliance on oil and at the same time invests in clean energy technologies that will power our future," the White House said in a statement.

It is unclear who, exactly would pay the tax if it were to pass, and how it would be structured. White House officials repeatedly stressed that the fee would fall on oil companies, but said it wouldn’t be charged at the wellhead and they look forward to working with Congress on the details.

The fee, which drew swift objections from oil industry groups and Republicans, is part of a broader administration plan to shift the nation away from transportation systems reliant on internal combustion engines and fossil fuels. The proposal envisions investing $20 billion to reduce traffic and improve commuting, $10 billion for state and local transportation and climate programs and $2 billion for research on clean vehicles and aircraft.

Phased In

The new oil tax, which would be phased in over five years, is all but certain to be rebuffed by Republicans who control both chambers of Congress.

“President Obama’s proposed $10 per barrel tax on oil is dead on arrival in the House," said House Majority Whip Steve Scalise, a Louisiana Republican.

Environmentalists applauded the move. "President Obama’s vision underscores the inevitable transition away from oil, and investments like this speed us along the way to a 100% clean energy future," Sierra Club Executive Director Michael Brune said in an e-mail.

Inadequate infrastructure raises costs for businesses and consumers, including motorists stuck in traffic -- a "hidden tax" and a harm to the environment, said Transportation Secretary Anthony Foxx.

Foxx said the plan increases investment in infrastructure in a way that combats climate change.

Transportation System

Oklahoma Senator Jim Inhofe, the Republican chairman of the Environment and Public Works Committee, said he agreed on the need to improve the nation’s transportation system but would oppose the oil tax.

"I’m unsure why the president bothers to continue to send a budget to Congress," Inhofe said in a statement. "His proposals are not serious, and this is another one which is dead on arrival. America is ready for a new president.”

Jeff Zients, director of the National Economic Council, told reporters that exported oil products wouldn’t be subject to the fee, even though imported ones would "across the board."

"We recognize oil companies will likely pass on some of these costs," Zients said.

Obama administration officials cast the additional cost as more than offset by the benefits of building better highways and transit systems.

"Make no mistake, this is an energy consumer tax disguised as an oil company fee," Neal Kirby, a spokesman for the Independent Petroleum Association of America, said by e-mail. "At a time when oil companies are going through the largest financial crisis in over 25 years, it makes little sense to raise costs on the industry."

Political Opening

The dip in gasoline prices may have created a political opening for Obama’s proposal, but it also could create tricky politics for one of the Democrats running to succeed him in the White House, Hillary Clinton.

Obama has used his annual budget request to Congress to go after tax deductions and incentives long enjoyed by oil and gas companies -- proposals that have never advanced on Capitol Hill.

"The president perennially proposes repealing the oil industry tax credits which Congress annually ignores," Benjamin Salisbury, a senior policy analyst at FBR Capital Markets, said by e-mail. "It seems overwhelmingly likely that this fee meets the same fate."

The plan comes with oil prices down 13 percent this year, thanks to increasing supply and a weakening U.S. dollar. Crude stockpiles climbed 7.79 million barrels to 502.7 million last week, the highest since the 1930s, according to weekly and monthly data from the Energy Information Administration.

‘Climate Activists’

House Speaker Paul Ryan, a Wisconsin Republican, said Obama “expects hard-working consumers to pay for his out-of-touch climate agenda."

"The president should be proposing policies to grow our economy instead of sacrificing it to appease progressive climate activists," he said in an e-mail.

Before the plan was announced, West Texas Intermediate for March delivery slipped 61 cents, or 1.9 percent, to $31.67 a barrel at 1:54 p.m. on the New York Mercantile Exchange.

Kevin Book, managing director of ClearView Energy Partners, a Washington-based research company, said there are "near-zero odds that the Republican-led Congress will grant the president’s request."

"A Congress without the political will to enact a $0.12 per gallon tax on gasoline sales that would have phased in over two years seems very unlikely to impose a new fee on oil companies that would amount to the equivalent of $0.238 per gallon phased in over five years," he said in a research note for clients.

Credit: http://www.bloomberg.com/

-

ASCOPE Officially Becomes a Member of Ipieca, Strengthening Commitment to Energy TransitionASCOPE has officially become a member of Ipieca, the global oil and gas industry association focused on advancing environmental performance and supporting the energy transition. This milestone marks an important step in ASCOPE’s efforts to strengthen its role in promoting responsible and sustainable energy development across the ASEAN region.

-

ASCOPE University Roadshow at Parahyangan Catholic University: Dialogue on ASEAN Energy and Regional IntegrationOn 18 December 2025, ASCOPE visited Parahyangan Catholic University (UNPAR) as part of its University Roadshow initiative to engage students in discussions on ASEAN’s evolving energy landscape. The session was attended by representatives from ASCOPE and Pertamina Energy Institute (PEI), alongside academics from UNPAR.

ASCOPE University Roadshow at Parahyangan Catholic University: Dialogue on ASEAN Energy and Regional IntegrationOn 18 December 2025, ASCOPE visited Parahyangan Catholic University (UNPAR) as part of its University Roadshow initiative to engage students in discussions on ASEAN’s evolving energy landscape. The session was attended by representatives from ASCOPE and Pertamina Energy Institute (PEI), alongside academics from UNPAR. -

ASCOPE Exploration and Production Task Force (EPTF) Successfully Hosts the 2nd EPTF Forum on Managing Mature Assets in Jakarta, Indonesia

The 2nd Exploration and Production Task Force (EPTF) Forum, themed “Managing Mature Assets,” was successfully held on 15 December 2025 in Jakarta, Indonesia. The forum brought together regional experts, industry leaders, and key stakeholders to discuss the challenges and opportunities associated with managing mature oil and gas assets across Southeast Asia.

-

ASCOPE University Roadshow at Universitas Pertamina Explores ASEAN’s Energy Transition and DiplomacyThe ASCOPE University Roadshow continued its outreach initiatives with a visit to Universitas Pertamina, featuring a session titled “From Oil Rigs to Green Grids: ASCOPE and the Future of ASEAN Energy Diplomacy.” The session served as a platform to engage students in discussions on the evolving energy landscape and ASEAN’s regional energy cooperation.

ASCOPE University Roadshow at Universitas Pertamina Explores ASEAN’s Energy Transition and DiplomacyThe ASCOPE University Roadshow continued its outreach initiatives with a visit to Universitas Pertamina, featuring a session titled “From Oil Rigs to Green Grids: ASCOPE and the Future of ASEAN Energy Diplomacy.” The session served as a platform to engage students in discussions on the evolving energy landscape and ASEAN’s regional energy cooperation. -

ASCOPE Conducts Courtesy Visit to Timor GAP to Strengthen Engagement Following Timor-Leste’s Accession to ASEANASCOPE conducted a courtesy visit to Timor GAP to acknowledge Timor-Leste’s official accession to ASEAN. This visit served as an important platform to strengthen engagement and foster closer ties between ASCOPE and Timor-Leste within the regional energy landscape.

ASCOPE Conducts Courtesy Visit to Timor GAP to Strengthen Engagement Following Timor-Leste’s Accession to ASEANASCOPE conducted a courtesy visit to Timor GAP to acknowledge Timor-Leste’s official accession to ASEAN. This visit served as an important platform to strengthen engagement and foster closer ties between ASCOPE and Timor-Leste within the regional energy landscape. -

ASCOPE as a speaker at ASEAN Energy Business forum (AEBF) 2025

ASCOPE as a speaker at ASEAN Energy Business forum (AEBF) 2025As part of the ASEAN Energy Business Forum (AEBF) 2025, ASCOPE participated as a speaker in conjunction with the celebration of its 50th anniversary. ASCOPE was honored to open the parallel session titled “Oil and Gas Business Strategies in the Energy Transition Era,” contributing to a strategic dialogue that reflected ASEAN’s collective progress toward energy resilience and sustainability.

-

ASCOPE Participates in the 43rd ASEAN Ministers on Energy Meeting in Kuala Lumpur

ASCOPE participated in the 43rd ASEAN Ministers on Energy Meeting (AMEM) held in Kuala Lumpur, where it highlighted key initiatives and progress in advancing regional energy cooperation. During the meeting, ASCOPE presented updates on strengthening regional energy connectivity, accelerating the development of gas and LNG, and enhancing collaboration in clean energy initiatives across ASEAN.

-

Strengthening Synergy: ASCOPE Stream Update Meeting 2025 Paves the Way for a Sustainable Energy Future

Strengthening Synergy: ASCOPE Stream Update Meeting 2025 Paves the Way for a Sustainable Energy FutureIn conjunction with the ASCOPE Council Meeting 2025, ASCOPE convened the Stream Update Meeting in Bangkok, Thailand. The session served as a strategic platform for representatives from all four Streams — Commercial, Clean Energy, Technical, and Policy — to share progress updates, key achievements, and upcoming initiatives.

-

ASCOPE Signs MoC with IOGP to Enhance Regional Energy Cooperation

ASCOPE has formally entered into a Memorandum of Cooperation (MoC) with the International Association of Oil & Gas Producers (IOGP), represented by Mr. Graham Henley, to strengthen collaboration on advancing the energy transition agenda in ASEAN. The MoC was signed on behalf of ASCOPE by Mr. Henricus Herwin, ASIC Executive Director.

-

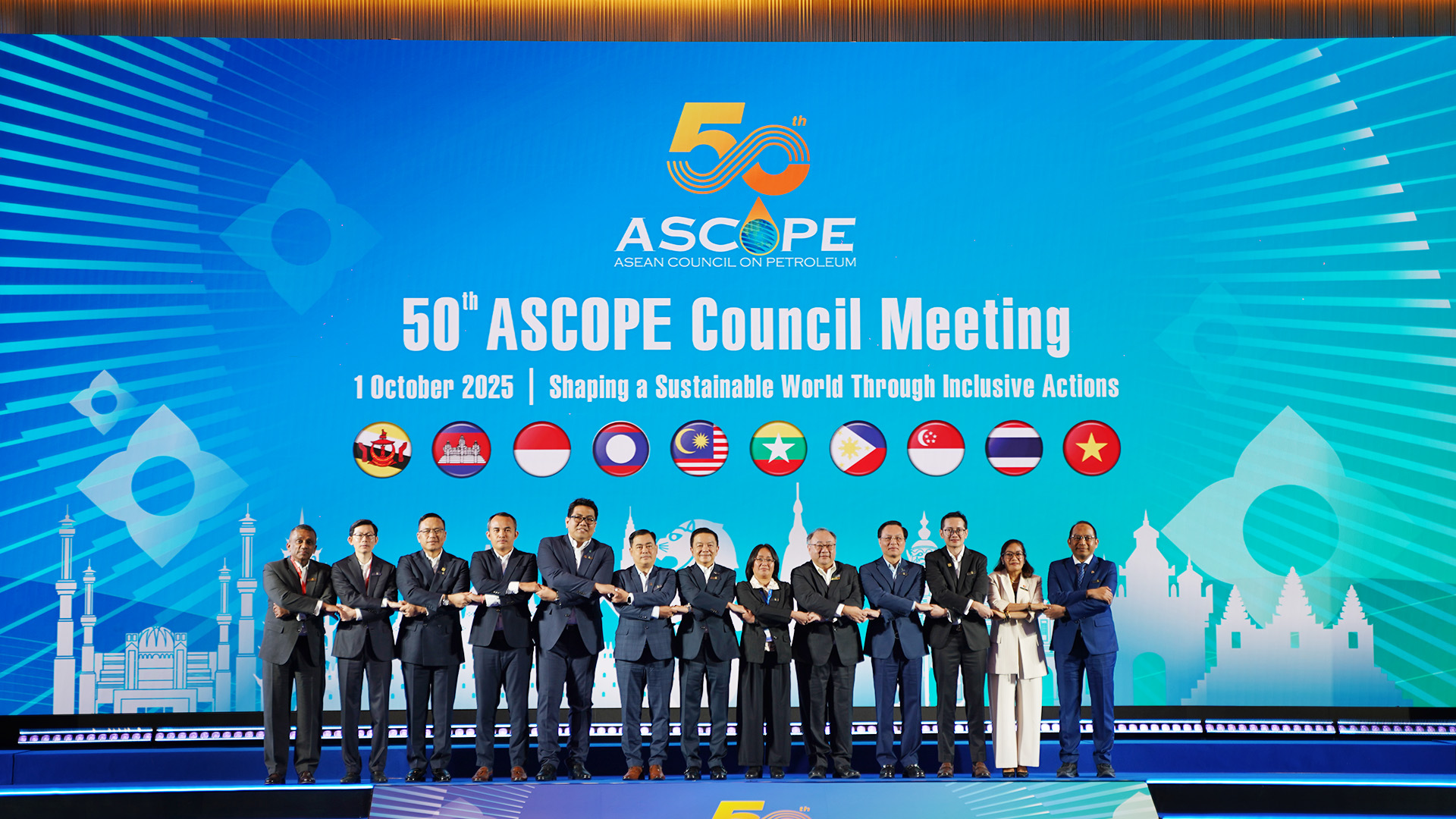

ASCOPE Marked a Historic Milestone for the Organization by Officially Launching its Charter during the 50th ASCOPE Council Meeting held in BangkokThe ASEAN Council on Petroleum (ASCOPE) marked a historic milestone with the official launch of the ASCOPE Charter during the 50th ASCOPE Council Meeting held in Bangkok, Thailand.

-

ASCOPE Strengthens Global Energy Collaboration at Council Meeting 2025 in BangkokBangkok, 1 October 2025 — The ASCOPE Council Meeting (ACM) and CEO Strategic Dialogue 2025 was successfully held in Bangkok, Thailand, hosted by PTT and organized in collaboration with the ASCOPE Secretariat (ASIC Office).

ASCOPE Strengthens Global Energy Collaboration at Council Meeting 2025 in BangkokBangkok, 1 October 2025 — The ASCOPE Council Meeting (ACM) and CEO Strategic Dialogue 2025 was successfully held in Bangkok, Thailand, hosted by PTT and organized in collaboration with the ASCOPE Secretariat (ASIC Office). -

ASCOPE Introductory Meeting with Indonesia's Ministry of Foreign AffairsOn 17 September 2025, ASCOPE held an introductory meeting with Indonesia’s Ministry of Foreign Affairs, specifically with the Directorate of ASEAN Economic Cooperation under the Directorate General of ASEAN Cooperation. The meeting aimed to formally introduce ASCOPE’s role and mandate, as well as to explore potential avenues for cooperation within the ASEAN framework.

ASCOPE Introductory Meeting with Indonesia's Ministry of Foreign AffairsOn 17 September 2025, ASCOPE held an introductory meeting with Indonesia’s Ministry of Foreign Affairs, specifically with the Directorate of ASEAN Economic Cooperation under the Directorate General of ASEAN Cooperation. The meeting aimed to formally introduce ASCOPE’s role and mandate, as well as to explore potential avenues for cooperation within the ASEAN framework. -

ASCOPE, in Collaboration with Partners, Launches the Methane Management Roadmap for Oil and Gas in ASEAN

On 13 June 2025, the ASEAN Council on Petroleum (ASCOPE), in partnership with the Global Flaring and Methane Reduction (GFMR) Partnership of the World Bank and the ASEAN Centre for Energy (ACE), officially launched the Methane Management Roadmap for Oil and Gas in ASEAN. The launch marked a significant regional milestone in strengthening collective efforts to address methane emissions within the oil and gas sector.

-

ASCOPE Strategic Update with the CEO & Presient Director of PertaminaOn 30 June 2025, ASCOPE recently held a strategic meeting with the CEO and President Director of Pertamina, Mr. Simon Aloysius Mantiri, who serves as Indonesia’s ASCOPE Council Member.

ASCOPE Strategic Update with the CEO & Presient Director of PertaminaOn 30 June 2025, ASCOPE recently held a strategic meeting with the CEO and President Director of Pertamina, Mr. Simon Aloysius Mantiri, who serves as Indonesia’s ASCOPE Council Member.

During the meeting, Mr. Henricus Herwin, ASCOPE Secretary-in-Charge (ASIC), delivered updates on the progress of four key Task Forces including upstream fiscal benchmarking and energy development in transboundary areas, infrastructure focused on regional gas and LNG integration, low-carbon initiatives (CCS/CCUS, methane management, and clean energy power grid), and capability building program.

ASIC also presented two milestone documents: ASEAN Plan of Action for Energy Cooperation (APAEC) 2026–2030 and ASCOPE Charter.

Both are set for adoption at the 50th ASCOPE Council Meeting this October in Bangkok, which will also commemorate ASCOPE’s 50th anniversary, a pivotal moment to reaffirm our commitment to regional energy security, collaboration, and a low-carbon future. -

ASCOPE Exploration & Production Task Force Benchmarking and Field Trip 2025 to Rokan Block IndonesiaOn June 24–25, 2025, the ASCOPE Exploration & Production Task Force (EPTF) held its Benchmarking & Field Trip hosted by Pertamina Hulu Rokan

Over 25 delegates from ASCOPE Member Countries explored PHR’s approach to managing mature assets, from Enhanced Oil Recovery (EOR) to steamflood technologies, plus insightful technical sessions in Pekanbaru, Minas, and Duri.

A great platform for sharing knowledge and strengthening regional collaboration under ASCOPE’s initiative on Managing Mature Assets. -

ASCOPE Clean Energy Task Force (CETF) Hosts Successful Panel Discussion in Jakarta, IndonesiaOn 25 June 2025, ASCOPE Clean Energy Task Force (CETF), hosted by PNRE, held a panel discussion on “Clean Energy Direction (in ASEAN and beyond) and Its Impact on the Oil and Gas Sector.”

ASCOPE Clean Energy Task Force (CETF) Hosts Successful Panel Discussion in Jakarta, IndonesiaOn 25 June 2025, ASCOPE Clean Energy Task Force (CETF), hosted by PNRE, held a panel discussion on “Clean Energy Direction (in ASEAN and beyond) and Its Impact on the Oil and Gas Sector.” -

ASCOPE Participated in the REPP-SSN MeetingASCOPE participated in the REPP SSN Meeting held on 28 May 2025 in Singapore, presenting updates on the Trans-ASEAN Gas Pipeline (TAGP) and APAEC Drafting Committee.

ASCOPE Participated in the REPP-SSN MeetingASCOPE participated in the REPP SSN Meeting held on 28 May 2025 in Singapore, presenting updates on the Trans-ASEAN Gas Pipeline (TAGP) and APAEC Drafting Committee.

This reflects ASCOPE’s ongoing support for regional energy cooperation and a sustainable ASEAN energy future. -

ASCOPE Collaborates with Pertamina Hulu Energi at the 49th IPA Conention & Exhibition 2025ASCOPE proudly collaborated with Pertamina Hulu Energi during the 49th IPA Convention & Exhibition (22 May 2025, ICE BSD, Indonesia), contributing to Pertamina’s booth and delivering a dedicated 30-minute session.

We spotlighted ASCOPE’s initiatives in upstream oil & gas to promote collaboration and supporting stronger technical cooperation across ASEAN. -

ASCOPE Exploration and Production Task Force Showcase at the 4th Indo Decomm in Oil and Gas Dissemination of the ADG Rev.01ACOPE EPTF showcased the ASCOPE Decomissioning Guidelines (ADG) Rev.01 at the 4th Indo Decomm Oil & Gas in Indonesia on 8-9 May 2025.

ASCOPE Exploration and Production Task Force Showcase at the 4th Indo Decomm in Oil and Gas Dissemination of the ADG Rev.01ACOPE EPTF showcased the ASCOPE Decomissioning Guidelines (ADG) Rev.01 at the 4th Indo Decomm Oil & Gas in Indonesia on 8-9 May 2025. -

ASCOPE Exploration & Production Task Force Forum 2025On May 7, 2025, the ASCOPE Exploration and Production Task Force Forum with the theme "Unlocking Investment Opportunities in ASEAN: Perspectives from Malaysia and Indonesia's Bid Rounds" was held in a hybrid format at Grha Pertamina, Indonesia, bringing together representatives from 10 ASEAN countries and Timor-Leste.

The forum focused on success stories from the Malaysia Bid Round (MBR) and Indonesia Petroleum Bid Round (IPBR), featuring upstream investments landscape. Discussions covered key topics such as fiscal terms, regulations, and digital innovations across ASEAN. -

ASCOPE 9th Mid-Year Task Force Meeting Successfully held in SingaporeSingapore LNG Pte Ltd successfully held the ASCOPE 9th Mid-Year Task Force Meeting 2025 from 23–25 April 2025 at the Conrad Singapore Marina Bay.

ASCOPE 9th Mid-Year Task Force Meeting Successfully held in SingaporeSingapore LNG Pte Ltd successfully held the ASCOPE 9th Mid-Year Task Force Meeting 2025 from 23–25 April 2025 at the Conrad Singapore Marina Bay.

The meeting successfully brought together key regional stakeholders to engage in impactful discussions on advancing energy collaboration within ASEAN.

We extend our appreciation to SLNG and all ASCOPE members for their valuable contributions to these important forums. -

The Exploration and Production Task Force (EPTF) Meeting was Held in the 9th Mid-Year Task Force MeetingOn 23rd April 2025, the Exploration and Production Task Force (EPTF) Meeting was Held during the 9th Mid-Year Task Force Meeting. Here are key highlights from the meeting:

-

The Clean Energy Task Force (CETF) Meeting was Held in the 9th Mid-Year Task Force MeetingOn 23rd April 2025, the Clean Energy Task Force (CETF) Meeting was Held during the 9th Mid-Year Task Force Meeting. Here are key highlights from the meeting:

-

The Gas Advocacy Task Force (GATF) Meeting was Held in the 9th Mid-Year Task Force MeetingOn 23rd April 2025, the Gas Advicacy Task Force (GATF) Meeting was Held during the 9th Mid-Year Task Force Meeting. Here are key highlights from the meeting:

-

The Policy, Research, and Capability Building Task Force (PRCBTF) Meeting was Held in the 9th Mid-Year Task Force MeetingOn 23rd April 2025, the Policy, Research, and Capability Building Task Force (PRCBTF) Meeting was Held during the 9th Mid-Year Task Force Meeting. Here are key highlights from the meeting:

-

ASCOPE Courtesy Visit to Singapore LNG Ptd LteOn November 1st, ASCOPE Secretary in Charge, Mr. Henricus Herwin, had the privilege of visiting Singapore LNG (SLNG) and meeting with its CEO, Mr. Leong Wei Hung. This courtesy visit was an opportunity to express ASCOPE’s sincere appreciation for SLNG’s invaluable contributions to the organization and to acknowledge their commitment to hosting the 9th ASCOPE Mid-Year Task Force in 2025. Exciting opportunities ahead for regional energy partnerships!

ASCOPE Courtesy Visit to Singapore LNG Ptd LteOn November 1st, ASCOPE Secretary in Charge, Mr. Henricus Herwin, had the privilege of visiting Singapore LNG (SLNG) and meeting with its CEO, Mr. Leong Wei Hung. This courtesy visit was an opportunity to express ASCOPE’s sincere appreciation for SLNG’s invaluable contributions to the organization and to acknowledge their commitment to hosting the 9th ASCOPE Mid-Year Task Force in 2025. Exciting opportunities ahead for regional energy partnerships! -

ASCOPE Courtesy Visit to ACE (ASEAN Centre Energy)On November 15, 2024, the ASCOPE Secretary in-Charge (ASIC) team visited the ASEAN Centre for Energy (ACE) and met with the Acting Executive Director, Mr. Beni Suryadi. The meeting focused on discussing regional policies and energy planning in ASEAN.

ASCOPE Courtesy Visit to ACE (ASEAN Centre Energy)On November 15, 2024, the ASCOPE Secretary in-Charge (ASIC) team visited the ASEAN Centre for Energy (ACE) and met with the Acting Executive Director, Mr. Beni Suryadi. The meeting focused on discussing regional policies and energy planning in ASEAN. -

.jpg) Methane Leadership Program (MLP) 2.0Sulawesi, Indonesia – November 19-20, 2024 – PT Pertamina successfully hosted the Methane Leadership Program (MLP) 2.0 Workshop, bringing together industry experts to discuss and enhance methane emission measurement techniques. The two-day event featured comprehensive field visits and technical discussions, underscoring Pertamina’s commitment to sustainable energy practices.

Methane Leadership Program (MLP) 2.0Sulawesi, Indonesia – November 19-20, 2024 – PT Pertamina successfully hosted the Methane Leadership Program (MLP) 2.0 Workshop, bringing together industry experts to discuss and enhance methane emission measurement techniques. The two-day event featured comprehensive field visits and technical discussions, underscoring Pertamina’s commitment to sustainable energy practices. -

ASCOPE Decommissioning Guidelines Rev. 01 has launched!The ASCOPE Decommissioning Guidelines (ADG) Revision 1 provides a unified framework for the safe, efficient, and environmentally responsible decommissioning of oil and gas facilities within ASCOPE member states. It references key international conventions, industry standards, and regional regulations, ensuring alignment with global best practices while addressing ASEAN-specific contexts. This milestone, achieved through the collaborative efforts of the ASCOPE Exploration and Production Task Force.

ASCOPE Decommissioning Guidelines Rev. 01 has launched!The ASCOPE Decommissioning Guidelines (ADG) Revision 1 provides a unified framework for the safe, efficient, and environmentally responsible decommissioning of oil and gas facilities within ASCOPE member states. It references key international conventions, industry standards, and regional regulations, ensuring alignment with global best practices while addressing ASEAN-specific contexts. This milestone, achieved through the collaborative efforts of the ASCOPE Exploration and Production Task Force. -

.jpeg) Methane Leadership Program (MLP) WorkshopOn Thursday, October 3, 2024, The MLP Workshop Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia. The Methane Leadership Program (MLP) Workshop discussed the recap of MLP 1.0, a list of Methane Leadership Program (MLP) 2.0 Partners, and a key objective of Methane Leadership Program (MLP) 2.0.

Methane Leadership Program (MLP) WorkshopOn Thursday, October 3, 2024, The MLP Workshop Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia. The Methane Leadership Program (MLP) Workshop discussed the recap of MLP 1.0, a list of Methane Leadership Program (MLP) 2.0 Partners, and a key objective of Methane Leadership Program (MLP) 2.0. -

Petronas Research Sdn Bhd (PRSB) Site VisitOn Thursday, October 3, 2024, the task force members had an agenda site visit in a series of events at the 49th ASCOPE Council Meeting. They visited the Petronas Research Sdn Bhd (PRSB). The site visit was held at Bangi, Selangor, Malaysia.

Petronas Research Sdn Bhd (PRSB) Site VisitOn Thursday, October 3, 2024, the task force members had an agenda site visit in a series of events at the 49th ASCOPE Council Meeting. They visited the Petronas Research Sdn Bhd (PRSB). The site visit was held at Bangi, Selangor, Malaysia. -

Methane Leadership Porgram (MLP) 1.0The Methane Leadership Program (MLP) 1.0 recap were held from June 2023 to October 2024. Some events were in this recap of the Methane Leadership Program (MLP) 1.0. First, MLP Launch & Deep Dive on Methane Management. Second, Introduction to Methane Management & OGMP 2.0. Third, Policy Direction, Tools, & ASEAN Experiences. Fourth, Tracking Methane Emissions from Oil & Gas Sectors. Fifth, Designing & Financing Methane Mitigation Projects.

Methane Leadership Porgram (MLP) 1.0The Methane Leadership Program (MLP) 1.0 recap were held from June 2023 to October 2024. Some events were in this recap of the Methane Leadership Program (MLP) 1.0. First, MLP Launch & Deep Dive on Methane Management. Second, Introduction to Methane Management & OGMP 2.0. Third, Policy Direction, Tools, & ASEAN Experiences. Fourth, Tracking Methane Emissions from Oil & Gas Sectors. Fifth, Designing & Financing Methane Mitigation Projects. -

42nd ASEAN Ministers on Energy Meeting was held in Vientiane, Lao PDROn Tuesday - Friday, September 24 - 27, 2024, The 42nd ASEAN Ministers on Energy Meeting and Its Associated Meetings were held in Vientiane, Lao PDR. The 42nd ASEAN Ministers on Energy Meeting was chaired by Mr. H.E. Phosay Sayasone, chairman of 42nd AMEM, and was attended by the International Energy Agency (IEA), International Renewable Energy Agency (IRENA), The 21st AMEM Plus Three, and The East Asia Summit Energy Ministers' Meeting.

42nd ASEAN Ministers on Energy Meeting was held in Vientiane, Lao PDROn Tuesday - Friday, September 24 - 27, 2024, The 42nd ASEAN Ministers on Energy Meeting and Its Associated Meetings were held in Vientiane, Lao PDR. The 42nd ASEAN Ministers on Energy Meeting was chaired by Mr. H.E. Phosay Sayasone, chairman of 42nd AMEM, and was attended by the International Energy Agency (IEA), International Renewable Energy Agency (IRENA), The 21st AMEM Plus Three, and The East Asia Summit Energy Ministers' Meeting. -

.jpeg) Nuclear Site VisitOn Thursday, October 3, 2024, the task force members had an agenda site visit in a series of events at the 49th ASCOPE Council Meeting. They visited the Nuclear Research Reactor. The site visit was held at Bangi, Selangor, Malaysia.

Nuclear Site VisitOn Thursday, October 3, 2024, the task force members had an agenda site visit in a series of events at the 49th ASCOPE Council Meeting. They visited the Nuclear Research Reactor. The site visit was held at Bangi, Selangor, Malaysia. -

ASIC and ASCOPE Country Coordinators MeetingOn Tuesday, October 1, 2024, the ASCOPE Secretary in Charge (ASIC) and Country Coordinator Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia.

ASIC and ASCOPE Country Coordinators MeetingOn Tuesday, October 1, 2024, the ASCOPE Secretary in Charge (ASIC) and Country Coordinator Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia. -

ASCOPE organised the 49th Council Meeting on October 2, 2024 in PetronasOn Wednesday, October 2, 2024, the Council Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia.

ASCOPE organised the 49th Council Meeting on October 2, 2024 in PetronasOn Wednesday, October 2, 2024, the Council Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia. -

The Exploration & Production Task Force (EPTF) Meeting was Held in the 49th Council Meeting 2024On Tuesday, October 1, 2024, the Exploration & Production Task Force (EPTF) Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia.

The Exploration & Production Task Force (EPTF) Meeting was Held in the 49th Council Meeting 2024On Tuesday, October 1, 2024, the Exploration & Production Task Force (EPTF) Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia. -

The Gas Advocacy Task Force (GATF) Meeting was Held in the 49th Council Meeting 2024On Tuesday, October 1, 2024, the Gas Advocacy Task Force (GATF) Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia.

The Gas Advocacy Task Force (GATF) Meeting was Held in the 49th Council Meeting 2024On Tuesday, October 1, 2024, the Gas Advocacy Task Force (GATF) Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia. -

.jpeg) The Clean Energy Task Force (CETF) Meeting was Held in the 49th Council Meeting 2024On Tuesday, October 1, 2024, the Clean Energy Task Force (CETF) Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia.

The Clean Energy Task Force (CETF) Meeting was Held in the 49th Council Meeting 2024On Tuesday, October 1, 2024, the Clean Energy Task Force (CETF) Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia. -

The Policy, Research, and Capability Building Task Force (PRCB) Meeting was Held in the 49th Council Meeting 2024On Tuesday, October 1, 2024, the Policy, Research, and Capability Building Task Force (PRCBTF) Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia.

The Policy, Research, and Capability Building Task Force (PRCB) Meeting was Held in the 49th Council Meeting 2024On Tuesday, October 1, 2024, the Policy, Research, and Capability Building Task Force (PRCBTF) Meeting was held in a series of events at the 49th ASCOPE Council Meeting. The event was held at Petronas Leadership Center in Selangor, Malaysia. -

Country Profiling 2024 is Out Now!Pertamina, as the ASCOPE Secretary in Charge, has released the Country Profiling Book, a publication that provides an overview of the energy landscape across 10 Southeast Asian countries. This book offers a comprehensive view of the energy sector, including the potential for collaboration among ASCOPE members. This document marks Pertamina’s strong commitment to strengthening cooperation, both through Government (G2G) and business-to-business (B2B), as one of the objectives of the ASCOPE Secretariat for the next five years, from 2024 to 2029.

Country Profiling 2024 is Out Now!Pertamina, as the ASCOPE Secretary in Charge, has released the Country Profiling Book, a publication that provides an overview of the energy landscape across 10 Southeast Asian countries. This book offers a comprehensive view of the energy sector, including the potential for collaboration among ASCOPE members. This document marks Pertamina’s strong commitment to strengthening cooperation, both through Government (G2G) and business-to-business (B2B), as one of the objectives of the ASCOPE Secretariat for the next five years, from 2024 to 2029. -

.jpg) ADG Book is Now Available for Sale Online!What is ADG Book?

ADG Book is Now Available for Sale Online!What is ADG Book? -

Pertamina Hosted the 8th ASCOPE (ASEAN Council on Petroleum) Mid-Year Task Force MeetingPertamina hosted the 8th ASCOPE (ASEAN Council on Petroleum) Mid-Year Task Force Meeting from May 27 to 30, 2024, at the Patra Bali Resorts and Villa. With the theme "Enhancing Energy Connectivity and Resilience," the meeting was attended by 150 participants from nine ASEAN Member States: Brunei Darussalam, Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.

Pertamina Hosted the 8th ASCOPE (ASEAN Council on Petroleum) Mid-Year Task Force MeetingPertamina hosted the 8th ASCOPE (ASEAN Council on Petroleum) Mid-Year Task Force Meeting from May 27 to 30, 2024, at the Patra Bali Resorts and Villa. With the theme "Enhancing Energy Connectivity and Resilience," the meeting was attended by 150 participants from nine ASEAN Member States: Brunei Darussalam, Cambodia, Indonesia, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam. -

ASCOPE organised the 48th Council Meeting on 22nd November 2023 successfullyThe 48th ASCOPE Council Meeting hosted by Petroliam Nasional Berhad (Petronas) was held via online platform on 22nd November 2023.

ASCOPE organised the 48th Council Meeting on 22nd November 2023 successfullyThe 48th ASCOPE Council Meeting hosted by Petroliam Nasional Berhad (Petronas) was held via online platform on 22nd November 2023. -

ASCOPE participated in the 41st ASEAN Ministers on Energy MeetingFrom 24 to 25 August 2023, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 41st ASEAN Ministers on Energy Meeting and its associated meetings (41st AMEM) in Bali, Indonesia.

ASCOPE participated in the 41st ASEAN Ministers on Energy MeetingFrom 24 to 25 August 2023, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 41st ASEAN Ministers on Energy Meeting and its associated meetings (41st AMEM) in Bali, Indonesia. -

ASCOPE successfully organised the 7th Mid-Year Task Force MeetingGroup photo at the 7th ASCOPE Mid-Year Task Force meeting

ASCOPE successfully organised the 7th Mid-Year Task Force MeetingGroup photo at the 7th ASCOPE Mid-Year Task Force meeting -

ASCOPE organised the 47th Council Meeting on 21st November 2022 via online platform

ASCOPE organised the 47th Council Meeting on 21st November 2022 via online platformThe 47th ASCOPE Council Meeting hosted by Lao State Fuel Company (LSFC) in coordination with ASCOPE Secretariat was held virtually on 21st November 2022.

-

ASCOPE successfully organised the 6th Mid-Year Task Force MeetingThe 6th ASCOPE Mid-Year Task Force and its asscociated meetings hosted by PTT Public Company Limited (PTT) were successfully organised from 3rd - 5th August, 2022 in Bangkok, Thailand.

-

ASCOPE participated in Seminar on the Role of Natural Gas in Advancing a Low-Carbon Energy Transition in the ASEAN RegionOn 10th November, 2021, ASCOPE participated in the “Seminar on the Role of Natural Gas in Advancing a Low-Carbon Energy Transition in the ASEAN Region” which was virtually hosted by Ministry of Energy Brunei Darussalam and co-hosted by ASEAN Centre for Energy (ACE).

ASCOPE participated in Seminar on the Role of Natural Gas in Advancing a Low-Carbon Energy Transition in the ASEAN RegionOn 10th November, 2021, ASCOPE participated in the “Seminar on the Role of Natural Gas in Advancing a Low-Carbon Energy Transition in the ASEAN Region” which was virtually hosted by Ministry of Energy Brunei Darussalam and co-hosted by ASEAN Centre for Energy (ACE). -

ASCOPE organised the 46th Council Meeting on 25th October 2021 via online platform for the first time in historyThe 46th ASCOPE Council Meeting hosted by PT Pertamina in coordination with ASCOPE Secretariat was held virtually on 25th October 2021 for the first time since ASCOPE’s establishment in 1975.

ASCOPE organised the 46th Council Meeting on 25th October 2021 via online platform for the first time in historyThe 46th ASCOPE Council Meeting hosted by PT Pertamina in coordination with ASCOPE Secretariat was held virtually on 25th October 2021 for the first time since ASCOPE’s establishment in 1975. -

ASCOPE participated in the 39th ASEAN Ministers on Energy MeetingFrom 13 to 16 September 2021, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 39th ASEAN Ministers on Energy Meeting and its associated meetings (39th AMEM) via online platform chaired by the Ministry of Energy, Brunei Darussalam. With the theme “We Care, We Prepare, We Prosper”, it is expected that ASEAN Member States would continue to closely collaborate to foster ASEAN’s sustainable energy sector.

ASCOPE participated in the 39th ASEAN Ministers on Energy MeetingFrom 13 to 16 September 2021, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 39th ASEAN Ministers on Energy Meeting and its associated meetings (39th AMEM) via online platform chaired by the Ministry of Energy, Brunei Darussalam. With the theme “We Care, We Prepare, We Prosper”, it is expected that ASEAN Member States would continue to closely collaborate to foster ASEAN’s sustainable energy sector. -

ASCOPE organised the 5th Mid-Year Task Force Meeting on 30th June 2021The 5th ASCOPE Mid-Year Task Force Meeting held on 30th June 2021 via online platform was chaired by ASCOPE Secretary-In-Charge Dr. Tran Hong Nam with more than sixty (60) participants from all ASCOPE members in ASEAN countries.

ASCOPE organised the 5th Mid-Year Task Force Meeting on 30th June 2021The 5th ASCOPE Mid-Year Task Force Meeting held on 30th June 2021 via online platform was chaired by ASCOPE Secretary-In-Charge Dr. Tran Hong Nam with more than sixty (60) participants from all ASCOPE members in ASEAN countries. -

ASCOPE participated in the Special Senior Officials Meeting on EnergyOn 21st January 2021, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam on behalf of ten (10) national oil and gas companies/entities responsible for oil and gas in each of the ASEAN Member State (ASCOPE members) paticipated at the Special Senior Officials Meeting on Energy “Special SOME” via online platform hosted by Vietnam.

ASCOPE participated in the Special Senior Officials Meeting on EnergyOn 21st January 2021, ASCOPE Secretary-In-Charge Dr. Tran Hong Nam on behalf of ten (10) national oil and gas companies/entities responsible for oil and gas in each of the ASEAN Member State (ASCOPE members) paticipated at the Special Senior Officials Meeting on Energy “Special SOME” via online platform hosted by Vietnam. -

ASCOPE participated in the 38th ASEAN Ministers on Energy MeetingFrom 17-20 November 2020, Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 38th ASEAN Ministers on Energy Meeting and Associated Meetings (38th AMEM) via online platform hosted by Viet Nam. With the theme “Energy transition towards sustainable development”, it is expected that ASEAN member states would closely cooperate together to build up a sustainable energy sector in ASEAN.

ASCOPE participated in the 38th ASEAN Ministers on Energy MeetingFrom 17-20 November 2020, Secretary-In-Charge Dr. Tran Hong Nam has represented ASCOPE at the 38th ASEAN Ministers on Energy Meeting and Associated Meetings (38th AMEM) via online platform hosted by Viet Nam. With the theme “Energy transition towards sustainable development”, it is expected that ASEAN member states would closely cooperate together to build up a sustainable energy sector in ASEAN. -

The 4th ASCOPE Mid-Year Task Force Meeting Held on 13th August 2020The 4th ASCOPE Mid-Year Task Force Meeting was held virtually for the first time on the 13th August 2020 due to Covid-19 pandemic situation. The meeting was chaired by Dr. Tran Hong Nam, ASCOPE Secretary-In-Charge and attended by ASCOPE Country Coordinators, Task Forces Chairpersons and Members.

The 4th ASCOPE Mid-Year Task Force Meeting Held on 13th August 2020The 4th ASCOPE Mid-Year Task Force Meeting was held virtually for the first time on the 13th August 2020 due to Covid-19 pandemic situation. The meeting was chaired by Dr. Tran Hong Nam, ASCOPE Secretary-In-Charge and attended by ASCOPE Country Coordinators, Task Forces Chairpersons and Members. -

Oil Capacity Building Program on Energy Security 2020 towards enhancing energy security in ASEAN regionDuring 17-20 February, 2020, ASCOPE’s Secretary- In- Charge Dr. Tran Hong Nam and his predecessor Mr. Nopporn Chuchinda participated in the Oil Capacity Building Program on Energy Security 2020 co-organized by Japan Oil, Gas and Metals National Corporation (JOGMEC) and ASEAN Centre for Energy (ACE) in association with Japan’s Agency for Natural Resources and Energy and the Ministry of Economy, Trade and Industry (MEITI).

Oil Capacity Building Program on Energy Security 2020 towards enhancing energy security in ASEAN regionDuring 17-20 February, 2020, ASCOPE’s Secretary- In- Charge Dr. Tran Hong Nam and his predecessor Mr. Nopporn Chuchinda participated in the Oil Capacity Building Program on Energy Security 2020 co-organized by Japan Oil, Gas and Metals National Corporation (JOGMEC) and ASEAN Centre for Energy (ACE) in association with Japan’s Agency for Natural Resources and Energy and the Ministry of Economy, Trade and Industry (MEITI). -

The 45th ASCOPE Council Meeting

The 45th ASCOPE Council Meeting -

Newsletter 2019_PRCBaa

Newsletter 2019_PRCBaa -

44th ASCOPE Council Meeting and Associated MeetingsDuring August 2018, the 44th ASCOPE Council Meeting and associated meetings were held in Thailand.

44th ASCOPE Council Meeting and Associated MeetingsDuring August 2018, the 44th ASCOPE Council Meeting and associated meetings were held in Thailand. -

THE 43rd ASCOPE Council Meeting and relating Taskforce Meetings.The 43rd ASCOPE Council Meeting, and relating Taskforce Meetings were held during 22-23 August 2017 in Singapore.

THE 43rd ASCOPE Council Meeting and relating Taskforce Meetings.The 43rd ASCOPE Council Meeting, and relating Taskforce Meetings were held during 22-23 August 2017 in Singapore. -

THE 42nd ASCOPE COUNCIL MEETING AND THE 82nd ASCOPE NATIONAL COMMITTEE CHAIRPERSON MEETINGTwo of the ASCOPE’s major events, The 42nd ASCOPE Council Meeting, and the 82nd ASCOPE National Committee Meeting were held during 6-9 September 2016 in Siem Reap, Cambodia.

THE 42nd ASCOPE COUNCIL MEETING AND THE 82nd ASCOPE NATIONAL COMMITTEE CHAIRPERSON MEETINGTwo of the ASCOPE’s major events, The 42nd ASCOPE Council Meeting, and the 82nd ASCOPE National Committee Meeting were held during 6-9 September 2016 in Siem Reap, Cambodia. -

ASCOPE Major Event: The 27th ASCOPE Joint Committees and The 81st ASCOPE National Committee Chairpersons MeetingASCOPE Major Event: The 27th ASCOPE Joint Committees and The 81st ASCOPE National Committee Chairpersons Meeting

ASCOPE Major Event: The 27th ASCOPE Joint Committees and The 81st ASCOPE National Committee Chairpersons MeetingASCOPE Major Event: The 27th ASCOPE Joint Committees and The 81st ASCOPE National Committee Chairpersons Meeting -

Obama to seek new tax on oil in budget proposalWASHINGTON: U.S. President Barack Obama will launch a long-shot bid next week to impose a $10-a-barrel tax on crude oil that would fund the overhaul of the nation's aging transportation infrastructure, the White House said on Thursday.

Obama to seek new tax on oil in budget proposalWASHINGTON: U.S. President Barack Obama will launch a long-shot bid next week to impose a $10-a-barrel tax on crude oil that would fund the overhaul of the nation's aging transportation infrastructure, the White House said on Thursday. -

Oil prices steady, weak fundamentals weigh after volatile weekCrude oil futures steadied on Friday after earlier losses, as bearish fundamentals weighed on markets at the end of a volatile week that saw prices seesaw over 10 percent within a day.

Oil prices steady, weak fundamentals weigh after volatile weekCrude oil futures steadied on Friday after earlier losses, as bearish fundamentals weighed on markets at the end of a volatile week that saw prices seesaw over 10 percent within a day. -

Asian stock markets mostly lower as oil extends fallSEOUL, South Korea (AP) — Asian stock markets were mostly lower Tuesday as the price of oil extended losses following a 6-percent plunge that was sparked by data showing a manufacturing slowdown in the world's two largest economies.

Asian stock markets mostly lower as oil extends fallSEOUL, South Korea (AP) — Asian stock markets were mostly lower Tuesday as the price of oil extended losses following a 6-percent plunge that was sparked by data showing a manufacturing slowdown in the world's two largest economies. -

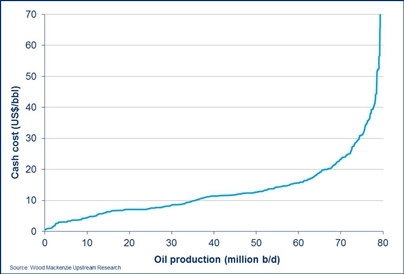

How Much Global Oil Output Halted Due to Low Prices? Just 0.1%After a year of low oil prices, only 0.1 percent of global production has been curtailed because it’s unprofitable, according to a report from consultants Wood Mackenzie Ltd. that highlights the industry’s resilience.

How Much Global Oil Output Halted Due to Low Prices? Just 0.1%After a year of low oil prices, only 0.1 percent of global production has been curtailed because it’s unprofitable, according to a report from consultants Wood Mackenzie Ltd. that highlights the industry’s resilience. -

ASCOPE NewslettersHappyNewYear 2016 to all ASCOPE family members!

ASCOPE NewslettersHappyNewYear 2016 to all ASCOPE family members! -

PETROLEUM EXPLORATION READY TO ROLLThailand is likely to start its 21st round of petroleum exploration this year, expecting to grant licences to upstream petroleum investors by next month, says the Mineral Fuels Department.

PETROLEUM EXPLORATION READY TO ROLLThailand is likely to start its 21st round of petroleum exploration this year, expecting to grant licences to upstream petroleum investors by next month, says the Mineral Fuels Department.